Loans

Federal Direct Loans

The Federal Direct Loan is funded by the Federal Government and is awarded as Subsidized (need based) and Unsubsidized (non-need based). The Federal Government is the lender.

If you qualified, detailed information was available in your aid package for that academic year. To accept your award, you will complete Entrance Interview Counseling. You will log into your my.SDSU Financial Aid tile and accept the loan and complete your Entrance Interview Counseling by the assigned deadline, including signing a promissory note.

If you leave or drop below half-time at SDSU, you must complete Exit Interview Counseling and sign your disclosure statements. Please click on the Exit Interview Counseling box above for more information.

Information on repayment of these loans can be found through Federal Student Aid at studentaid.gov

Federal Perkins Loans

(This program was terminated September 30, 2017; please read if you received this type of loan.)

The Federal Perkins Loan is a low-interest (5 percent) loan for eligible undergraduate and graduate students with exceptional financial need. The loan is funded by Federal and SDSU funds. If you qualified, detailed information was available in your aid package for that academic year. You were not necessarily required to sign a new promissory note each year, as these disbursements are under provisions of your Master Promissory Note. SDSU acts as the lender.

If you leave or drop below half-time at SDSU, you must complete Exit Interview Counseling and sign your disclosure statements. Please click on the Exit Interview Counseling box above for more information.

Repayment of these loans is through SDSU’s billing service, Heartland Educational Computer Systems, Inc. (ECSI) at https://heartland.ecsi.net/.

sums of money on several student loans, or who have high monthly payments, or several loans with different lenders. More information on consolidation can be found at the Department of Education.

University Long Term Loan

The University Long Term Loan is awarded to qualifying students who need assistance but are unable to meet their needs through existing programs. The loan is funded by SDSU funds. SDSU is the lender.

If you qualify, detailed information was available in your aid package for that academic year. To accept your award, you will complete Entrance Interview Counseling. You will log into your my.SDSU Financial Aid tile and accept the loan and complete your Entrance Interview Counseling by the assigned deadline, including signing a promissory note.

If you leave or drop below half-time at SDSU, you must complete Exit Interview Counseling and sign your disclosure statements. Please click on the Exit Interview Counseling box above for more information.

Repayment of these loans is through SDSU’s billing service, Heartland Educational Computer Systems, Inc. (ECSI) at https://heartland.ecsi.net/.

California Dream Loans

The California Dream Loan is awarded to eligible undergraduate students with a valid California Dream Act Application and a valid AB540 affidavit on file with the University. The loan is funded by state and SDSU funds. SDSU is the lender.

If you qualify, detailed information was available in your aid package for that academic year. To accept your award, you will complete Entrance Interview Counseling. You will log into your my.SDSU Financial Aid tile and accept the loan and complete your Entrance Interview Counseling by the assigned deadline, including signing a promissory note.

If you leave or drop below half-time at SDSU, you must complete Exit Interview Counseling and sign your disclosure statements. Please click on the Exit Interview Counseling box above for more information.

Repayment of these loans is through SDSU’s billing service, Heartland Educational Computer Systems, Inc. (ECSI) at https://heartland.ecsi.net/.

Exit Interview Counseling

What is Exit Counseling?

Exit Counseling is a required process to prepare you for repayment of your loan, inform you of the terms and benefits and provide updated contact information.

You will be prompted when your enrollment status at SDSU changes and also when you apply for graduation.

Exit Counseling Requirements

Did you know? Federal Regulations require you to complete Exit Counseling when you:

- Drop below half-time status at SDSU

- Transfer to another school

- Graduate and not immediately return the following semester as at least a half-time student at SDSU

- Even if you have an approved leave of absence

For any of the following loans received while attending SDSU:

- Federal Direct Loan

- Federal Perkins Loan

- University Long Term Loan

- California Dream Loan

Complete Exit Counseling

Direct Loans

- SDSU will send you notifications with a link to complete your Exit Counseling on the Federal Student Aid website, anytime your enrollment drops.

- You can also login to the FSA Website at https://studentaid.gov/exit-counseling/

- Or download the Exit Counseling Guide at https://studentaid.gov/sites/default/files/exit-counseling.pdf

Perkins, Dream and University Long Term Loans

- Heartland ECSI will send you notifications with a link to complete your Exit Counseling on ECSI’s website, anytime your enrollment drops. SDSU will be notified when completed.

- You can also register and login to ECSI at https://heartland.ecsi.net/. School Code is A7 and Account Number is SSN, RedID or EMPLID

- A hold will be placed on your records until the Exit Counseling is completed and will be released once all electronic documents are filled out completely and accurately

- ECSI will notify SDSU once all forms are completed and signed.

- If you have questions, please contact the Cal Coast Student Financial Center.

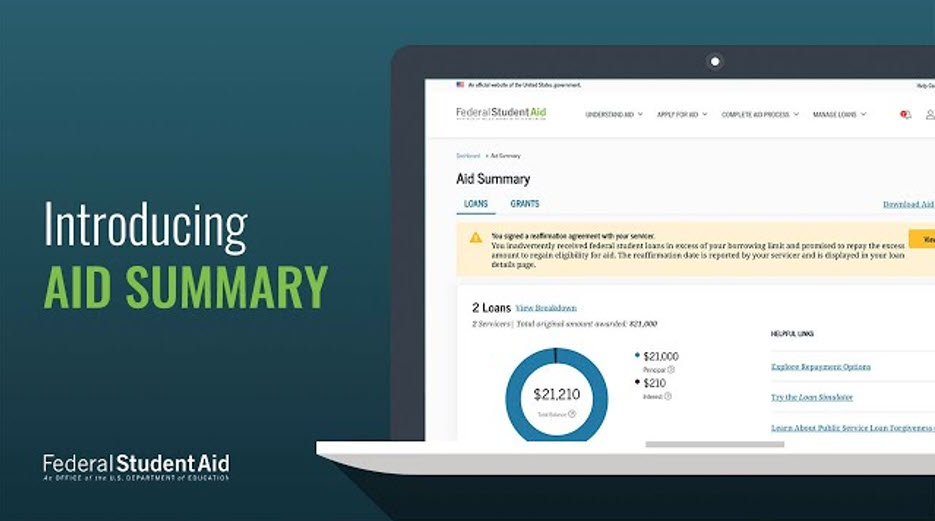

Aid Summary

Review your aid history on the Department of Education's National Student Loan Data System.