Tax Information

What do you need assistance with?

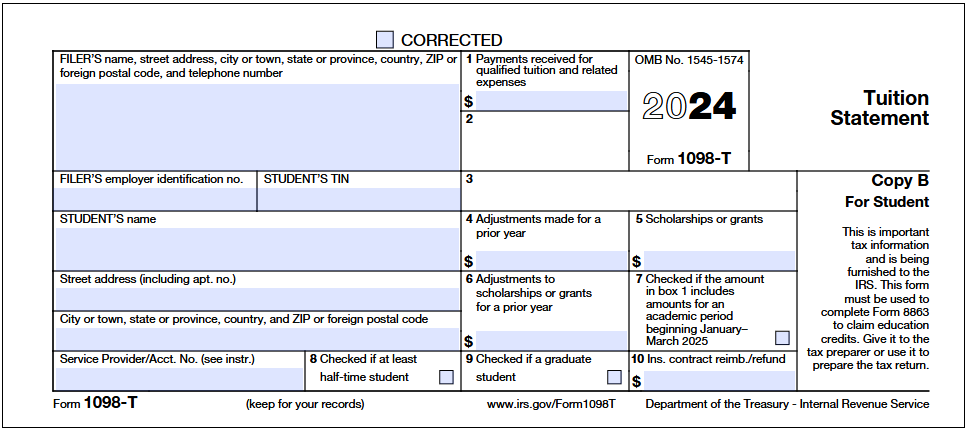

Overview of IRS Form 1098-T

Form 1098-T is an information form filed with the Internal Revenue Service (IRS) which reports the amount you paid for qualified tuition expenses. This form will help you make decisions regarding the claiming of educational tax credits via Form 8863 and Form 1040 / 1040A. SDSU will prepare Form 1098-T by January 31st each year.

There is no IRS requirement that you must claim the tuition and fees deduction, or education credit. Claiming education tax benefits is a voluntary decision for those who may qualify.

Use this student guide to learn more about the Form 1098-T.

Downloading 1098-T

Save time and hassle by opting for online delivery of your IRS Form 1098-T.

It’s quick, easy, and you’ll have instant access to your form whenever you need it. Simply update your preferences through the Financial Account tile on my.SDSU.

Click here for step-by-step instructions on opting in for online delivery.

*Note: Parent Accounts cannot access Form 1098-T, only a student may retrieve the form using their own student credentials.

By default, SDSU mails Form 1098-T to the home address on file, but you can avoid waiting by choosing the online delivery instead.

Former Students

If you are a former student and do not have access to My.SDSU, Form 1098-T can be mailed or picked up in our office.

Please send a request by filling out this form.

Note: 1098-Ts will only be mailed to home address on file.

Explanation of 1098-T Form Fields

Shows any adjustment made by an eligible educational institution for a prior year for qualified tuition and related expenses that were reported on a prior year Form 1098-T. This amount may reduce any allowable education credit that you claimed for the prior year (may result in an increase in tax liability for the year of the refund).

Shows the total of all scholarships or grants administered and processed by the eligible educational institution. The amount of scholarships or grants for the calendar year (including those not reported by the institution) may reduce the amount of the education credit you claim for the year.

Reports whether you are considered to be carrying at least one-half of the normal full-time course load for your course of study at SDSU.

Reports whether you are considered to be enrolled in a program leading to a graduate degree, graduate-level certificate, or other recognized graduate-level educational credential.

American Opportunity Tax Credit (AOTC)

The American Opportunity Tax Credit allows taxpayers to claim a credit up to $2,500 for qualified education expenses paid for each eligible student for the first four years of higher education. An overview of eligibility and claiming the credit is provided for your convenience.

Eligibility

An eligible students is either the taxpayer, taxpayer's spouse, or a dependent who is claimed as an exemption on the taxpayer's tax return. The student must meet the following:

- Pursuing a degree or recognized education credential

- Is enrolled at least half-time for at least one academic period beginning in the tax period

- Not finished with the first four years of higher education at the beginning of the tax year

- Has not claimed the AOTC or the former Hope credit for more than four years

- Does not have a felony drug conviction at the end of the tax year

Claiming the Credit

To claim the AOTC you must complete IRS Form 8863 and attach it to your Form 1040 or Form 1040A.

Lifetime Learning Credit (LLC)

The Lifetime Learning Credit allows taxpayers to claim a maximum credit of $2,000 per tax return for eligible students enrolled in an eligible educational institution. This credit can help pay for undergraduate, graduate, and professional degree courses. An overview of eligibility and claiming the credit is provided below.

Eligibility

An eligible students is either the taxpayer, taxpayer's spouse, or a dependent who is claimed as an exemption on the taxpayer's tax return. The student must meet the following:

- Be enrolled or taking courses at an eligible educational institution

- Be taking higher education course(s) to get a degree, recognized education credential, or improve job skills

- Be enrolled for at least one academic period beginning in the tax year

Claiming the Credit

To claim the LLC you must complete IRS Form 8863 and attach it to your Form 1040 or Form 1040A.

Additional Information

- A student who is claimed as a dependent cannot claim tax credit on their own tax return

- The information shown on 1098-T is related to the calendar (tax) year

- A student may not be able to claim tax credit if a third party paid the student's expenses shown on 1098-T

- When preparing tax returns, always check with a professional or the IRS to make sure the latest regulations are followed

- Use IRS form 8863 to claim tax credit

Information contained in 1098-T only includes registration-related fees. Additional qualified expenses that do not appear on 1098-T include:

- Application for Admission Fee (if subsequently enrolled at SDSU)

- Graduation Services Fee

- Credential Evaluation Fee

- Miscellaneous Course Charges (such as Nutrition and Art-Ceramics Clay)

- Mandatory Lab Fees

- Equitable Access Fee

- Health & Wellness Fee

- Student Involvement Rep Fee

Consult with a tax professional or the IRS for guidance on reporting these qualified fees.

Where to obtain information related to to 1098-T and taxes:

- IRS website: https://www.irs.gov

- IRS phone number: 800.829.1040

- IRS form 8863

- IRS publication 970

SDSU does not assist in tax preparation, act as a tax consultant for individuals or entities, provide tax advice, and cannot answer your tax questions. Please consult a tax professional, the IRS, or a financial planner who is proficient with tax and tax laws. Each student and/or their parents must determine eligibility for, calculation of, and limitation of the tuition and fees deduction or the education credits.

While the University has made every effort to use the most current and accurate data, tax laws change frequently, and it is possible that some of the information may no longer be accurate. The university disclaims all liability from the mistreatment of information and materials contained in this webpage. Information regarding immigration, employment, and tax substantial authority are the responsibility of each individual. Please keep in mind that no one from SDSU, while in their official role at the university, can act as a tax consultant, give personal, legal, or tax advice, or represent an individual dealing with the Internal Revenue Service. Thus, any assistance the above information may provide is given as a courtesy to you, and as such, should not be construed in any way as the rendering of legal or tax advice.